Inflation has become one of the great issues of our times. The UK’s is the highest in the G7, weighing in at 9% a year according to the most recent figures on consumer price inflation.

When you look at the other common measure for prices, retail price inflation, which adds mortgage rates into the equation and is also calculated a little differently, it is even higher at 11%. This is important because RPI is used for raising prices across a range of items, from train tickets and mobile phone contracts to student loans.

The question of why inflation is so high is well rehearsed. The initial impetus came from greater demand, but it is being further fuelled by supply issues.

What caused high inflation

On the demand side, quantitative easing (QE) during the pandemic – in which central banks “created money” to help prop up the economy – has increased the amount of money in the system by over 20%.

When lockdown ended, this helped to ensure that there was pent-up demand for goods and services: retail sales rose by over 20% year on year in May 2021, for instance, and hit another peak of nearly 10% in January 2022. At the same time, demand from firms helped to drive huge price increases in key industrial commodities such as copper and steel. Also, oil prices rose by approximately 67% in 2021 and another 20% in 2022 to date.

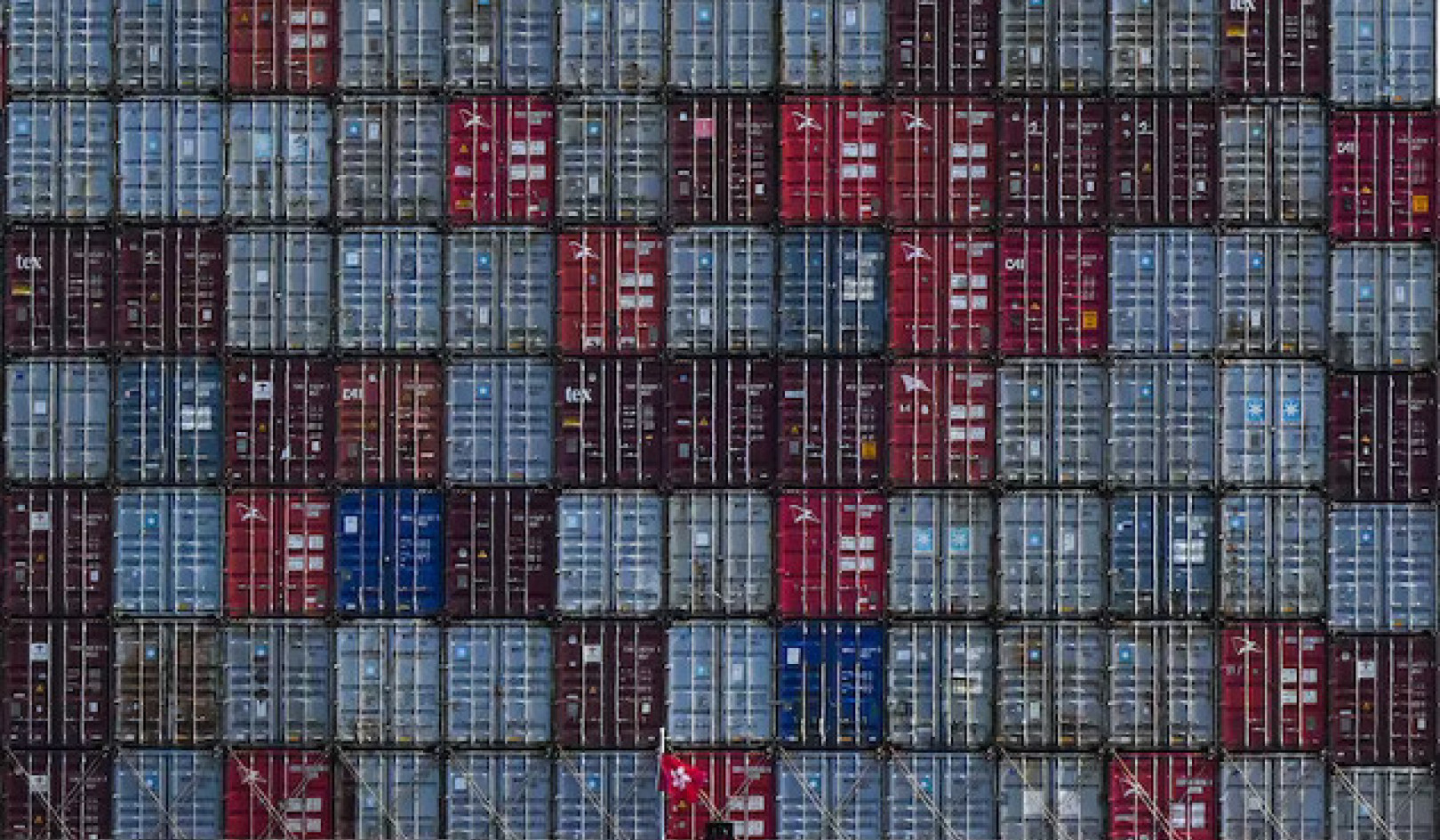

Heightened demand has collided with constraints on the global supply chain from social distancing, self-isolation rules and renewed lockdowns in China (even the Ever Given getting stuck). As a result, the cost of shipping goods is around 35% higher than the pre-pandemic high (and over 700% higher than its low). And all of this is before discussing the war in Ukraine.

The response by the Bank of England has been to increase the headline rate of interest from 0.1% to 1%, and to stop QE. Tightening monetary policy affects demand as the interest due on many debt repayments is rising and the cost of borrowing is going up. As a result, the GfK UK consumer confidence index is sitting at -40, a historically low level (when the number is positive, it means consumer confidence is high).

This combination of higher interest rates and higher prices has increased the likelihood of a recession. In part, this is because increasing interest rates discourages businesses from investing. But there’s also another problem with discouraging investment: it’s part of the long-term solution to our inflation problem.

Productivity and investment

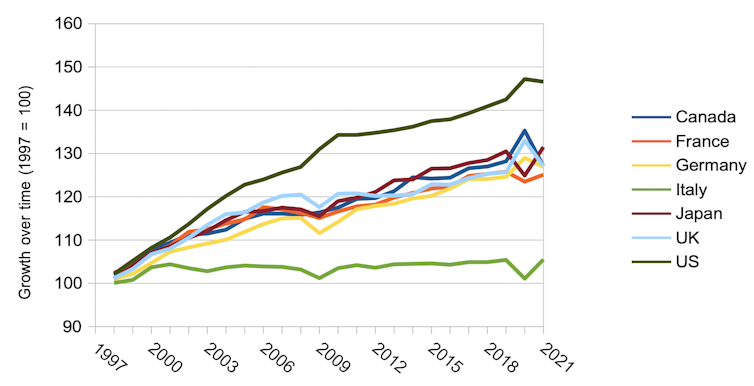

This is linked to the UK’s long-term problem with productivity: in other words, how much each worker produces. The UK productivity rate is growing, which you would expect as technology brings improvements, but the growth is less than that of key international competitors like the US, Germany and France.

While the rate of growth has returned to pre-pandemic levels after plunging during the lockdowns, it is still slower than in the years before the global financial crisis of 2007-09. A PwC report from 2019 highlights that annual growth in UK productivity was 2% for the ten years to 2008 and 0.6% for the ten years after, with a productivity gap of approximately 10% to Germany and over 30% to the US.

G7 productivity growth, 1997-2021

Why does productivity matter for inflation? When a workforce is more productive it produces more goods and services, and at a lower cost per unit. This means there is a greater supply of these things, which puts downward pressure on prices and is therefore associated with lower inflation.

How do we raise productivity? One important way is to invest more, but this has been a weakness in the UK. Business investment plateaued in 2016 following the Brexit referendum, fell with COVID-19 and remains almost 10% below the 2019 level. The nation’s investment spending as a proportion of GDP (16.7%) compares poorly with the US (22.5%), Japan (25%) and the EU (24.3%). This is despite evidence that UK companies are holding £140 billion in cash and have a backlog of accumulated projects.

What can be done

The question is how to encourage firms to release this investment potential. The government is planning to increase headline corporation tax from 19% to 25% in 2023, which is not going to help and should arguably be scrapped. To further incentivise investment, there’s also a need for more generous rules around tax relief, including extending the “super-deduction” that was brought in two years ago, which can reduce companies’ tax bills by 25%.

As well as encouraging companies to invest and expand, the government needs to incentivise people to start new companies. For example, the UK has lost three-quarters of a million self-employed workers since February 2020.

To encourage more start-ups, the UK government, the devolved administrations and councils need to come together to develop strategic plans for different regions. This includes making better use of universities as local hubs for expertise and developing clusters of similar firms based on local specialisms that can help one another by sharing equipment and collaborating. Plans exist, but need to be actioned; levelling up must be more than a catchy slogan.

Public investment has to be part of the picture. This especially includes education, both at school, where upgraded facilities are required to ensure that young people are fully trained in the latest technology; and for over-18s, with a clearer balance between university and apprenticeship training.

Getting east to west is about to become substantially easier in London thanks to Crossrail, but remains tortuous elsewhere, whether from Leeds to Manchester or Edinburgh to Glasgow. Quicker transport links improve the mobility of goods and labour, while truly upgrading internet connections (full fibre and 5G) improves links when travel isn’t necessary. Both improve productivity.

Inevitably, these kinds of interventions involve further spending. But this has to be viewed as a long-term solution. After WWII, government debt was well over 200% of GDP and took 50 years to be paid off. The same time scale can be considered now.

UK Chancellor Rishi Sunak has been talking a lot about the need to unlock investment and raise productivity, but there is still very little detail about what the government intends to do. There are lots of economic benefits to raising productivity, but bringing down inflation is the one that everyone seems to have missed.

About The Author

![]()

David McMillan, Professor in Finance, University of Stirling

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Recommended books:

Capital in the Twenty-First Century

by Thomas Piketty. (Translated by Arthur Goldhammer)

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. But economic trends are not acts of God. Political action has curbed dangerous inequalities in the past, says Thomas Piketty, and may do so again. A work of extraordinary ambition, originality, and rigor, Capital in the Twenty-First Century reorients our understanding of economic history and confronts us with sobering lessons for today. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

Click here for more info and/or to order this book on Amazon.

Nature's Fortune: How Business and Society Thrive by Investing in Nature

by Mark R. Tercek and Jonathan S. Adams.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

What is nature worth? The answer to this question—which traditionally has been framed in environmental terms—is revolutionizing the way we do business. In Nature’s Fortune, Mark Tercek, CEO of The Nature Conservancy and former investment banker, and science writer Jonathan Adams argue that nature is not only the foundation of human well-being, but also the smartest commercial investment any business or government can make. The forests, floodplains, and oyster reefs often seen simply as raw materials or as obstacles to be cleared in the name of progress are, in fact as important to our future prosperity as technology or law or business innovation. Nature’s Fortune offers an essential guide to the world’s economic—and environmental—well-being.

Click here for more info and/or to order this book on Amazon.

Beyond Outrage: What has gone wrong with our economy and our democracy, and how to fix it -- by Robert B. Reich

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

In this timely book, Robert B. Reich argues that nothing good happens in Washington unless citizens are energized and organized to make sure Washington acts in the public good. The first step is to see the big picture. Beyond Outrage connects the dots, showing why the increasing share of income and wealth going to the top has hobbled jobs and growth for everyone else, undermining our democracy; caused Americans to become increasingly cynical about public life; and turned many Americans against one another. He also explains why the proposals of the “regressive right” are dead wrong and provides a clear roadmap of what must be done instead. Here’s a plan for action for everyone who cares about the future of America.

Click here for more info or to order this book on Amazon.

This Changes Everything: Occupy Wall Street and the 99% Movement

by Sarah van Gelder and staff of YES! Magazine.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

This Changes Everything shows how the Occupy movement is shifting the way people view themselves and the world, the kind of society they believe is possible, and their own involvement in creating a society that works for the 99% rather than just the 1%. Attempts to pigeonhole this decentralized, fast-evolving movement have led to confusion and misperception. In this volume, the editors of YES! Magazine bring together voices from inside and outside the protests to convey the issues, possibilities, and personalities associated with the Occupy Wall Street movement. This book features contributions from Naomi Klein, David Korten, Rebecca Solnit, Ralph Nader, and others, as well as Occupy activists who were there from the beginning.

Click here for more info and/or to order this book on Amazon.